Sensational Tips About How To Avoid Finance Charges

While you can incur credit card finance charges in a few ways, you can also avoid them entirely.

How to avoid finance charges. How to avoid finance charges. The best way to avoid finance charges is by paying your balances in full and on time each month.as long as you pay your full balance within the grace period. If you fail to pay off.

How do i avoid finance charges? How to avoid paying credit card finance charges. Don’t use credit cards abroad.

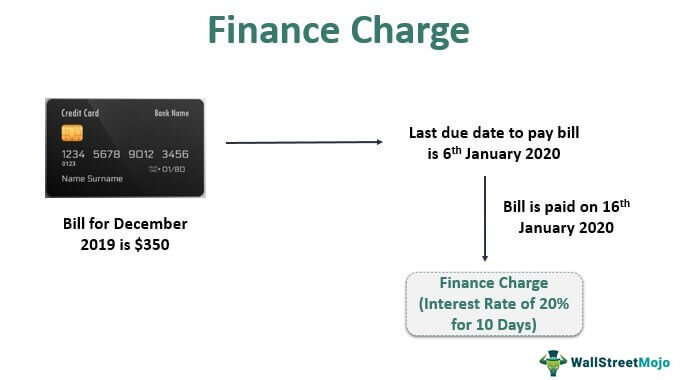

Look at the best apr offers if you need. If your card has a grace period, you must pay off the balance in full before the end of this period to avoid any finance charges. Your credit card finance charge relies on the three factors mainly:

Credit cards are required to give you what’s called. With credit cards, you can generally avoid finance charges if you pay off your full statement balance by the due date. Since finance charges are the credit card issuer's way of charging you for carrying a balance, the simple way to avoid finance charges is to pay your full balance each month.

Five tips to avoid finance charge on your credit card 1. Because a finance fee is how the credit card issuer charges you for upholding balance, the only way to avoid paying finance charges is to completely pay your credit card bill. By paying these fees upfront, you eliminate interest payments on.

How to avoid finance charges. The best way to avoid finance charges is bypaying your balances in full and on time each month. How to avoid finance charges on credit cards: