Impressive Info About How To Buy Delinquent Debt

/debt-1500774_1920-52266c62700945a3bb08ccf6b9323267.png)

A debt becomes delinquent the day after you miss a payment.

How to buy delinquent debt. If you’re looking to buy a debt portfolio, then the first thing that you should do is find a reputable debt broker. You guessed it, delinquent debt. On our loan marketplace they buy and sell all sorts of debt portfolios:

Once the auction is complete, the next step is to pay for the tax bill and debt associated with the property. There are two main methods for purchasing defaulted credit card debt. Still, you should act sooner than later to try to address the.

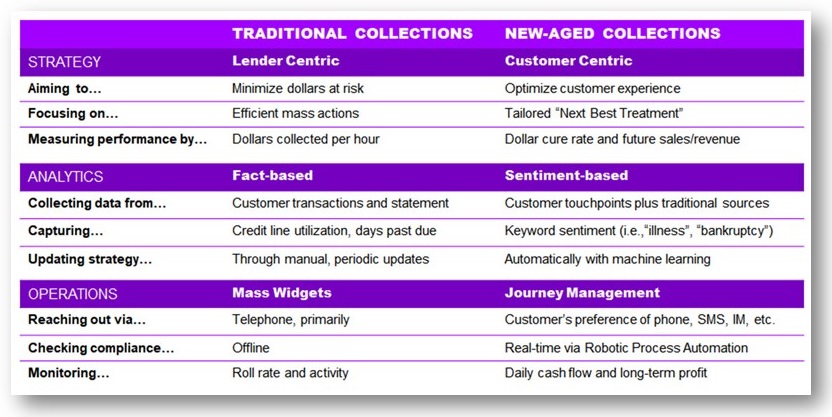

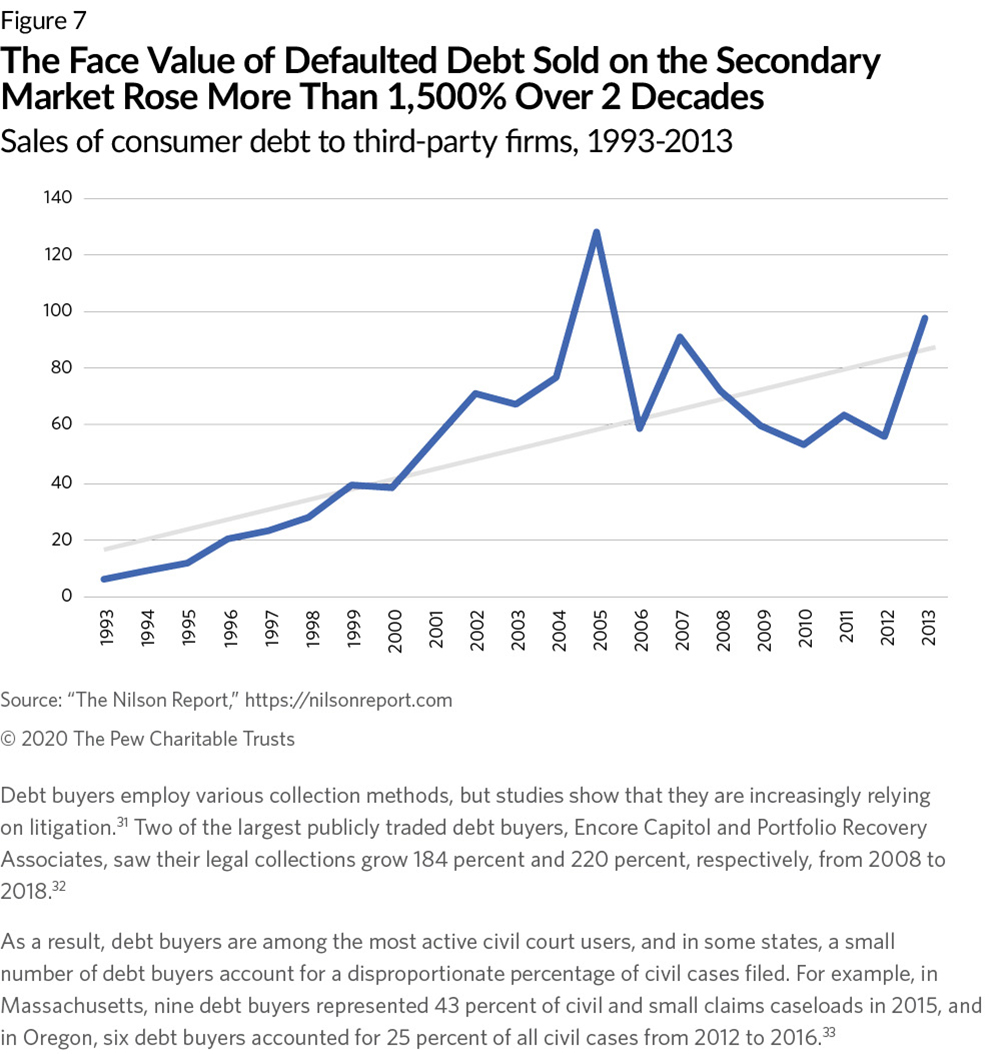

The fastest way we know to establish your credibility and begin working relationships with current or new prospects is to buy a few million dollars of. Brokers are the middlemen who help facilitate trades between buyers and sellers. Up to 25% cash back if you're delinquent on one of your debts, the creditor might sell that debt to a debt buyer. a debt buyer is different than a collection agency.

If you’re looking to buy a debt portfolio, then the first thing that you should do is find a reputable debt broker. Real estate notes, auto notes, payday portfolios, installment portfolios, medical debt, commercial notes, mca debt,. Brokers are the middlemen who help facilitate trades between buyers and sellers.

Most debt collection is done by mail and telephone. What it means to be delinquent on debt. What can you do if you have delinquent debt?

If you have delinquent debt or debt in collections, you are not alone. If you’re looking to buy a debt portfolio, then the first thing that you should do is find a reputable debt broker. Brokers are the middlemen who help facilitate trades between buyers and sellers.

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

/debttextonpaper-5bfc315246e0fb00265cfc12.jpg)