Fabulous Info About How To Reduce Finance Charges

And that can save you a few dollars if you find yourself consistently exceeding.

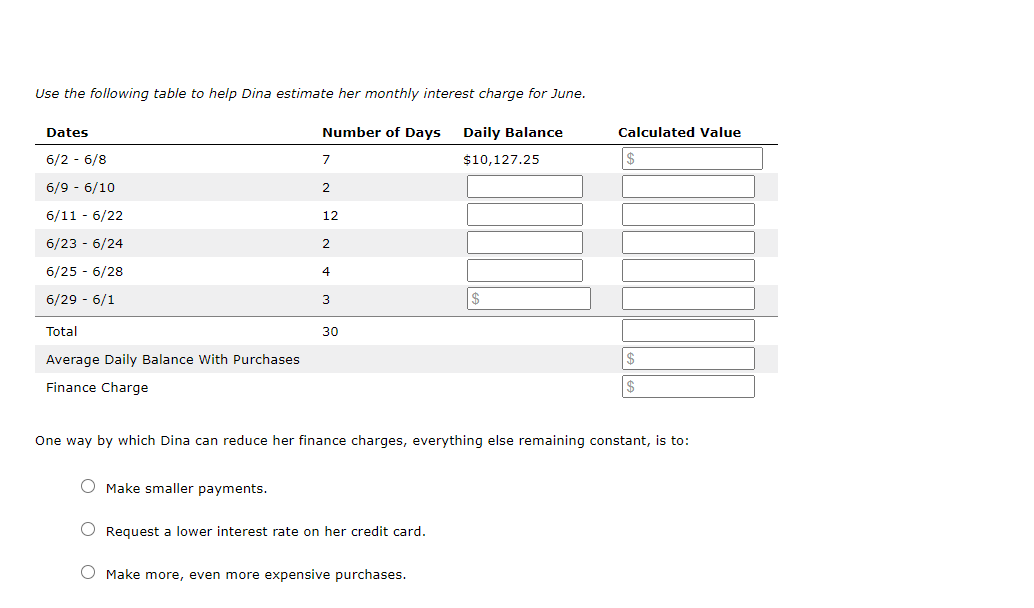

How to reduce finance charges. But there is no loan being sold… so that is out! Basically, a credit cardholder needs to pay finance charges for carrying a balance (as seen in example 1), and thus finance charges can be avoided by paying the full balance every month. If you can swing it, pay twice as much as the monthly minimum.

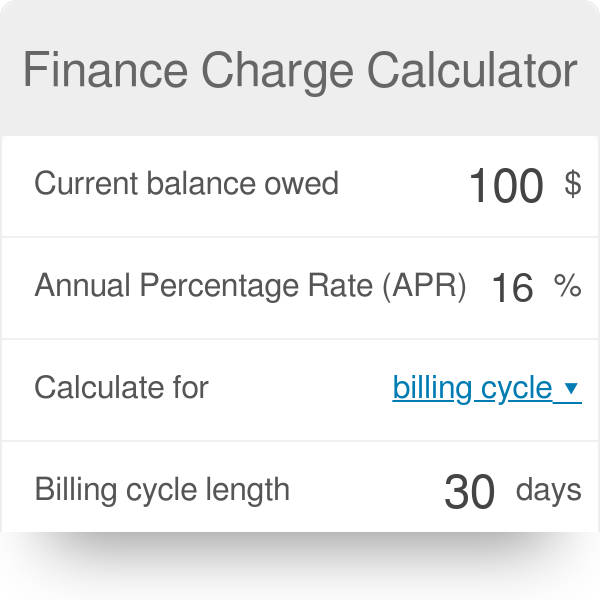

Refinance debt to get a lower interest rate pay off debt so that you don’t pay any interest at all They might try to charge a “discount”. Most credit cards allow you to pay off purchases without being.

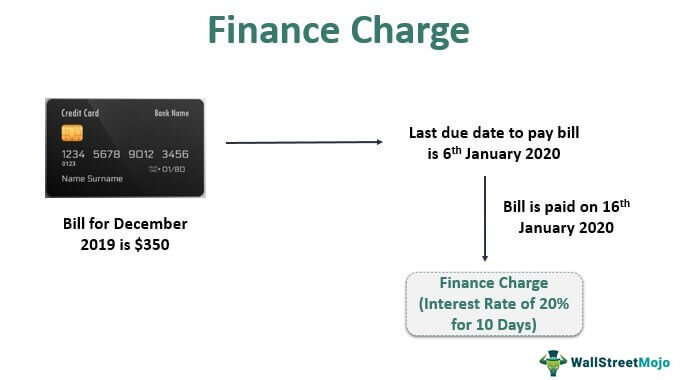

The best way to avoid these charges is to pay off the balance on time. The more you pay in a month, the more the principal of your loan is reduced, which. For credit cards, payment of the entire balance during the grace period each month prevents the accumulation of finance charges.

Paying extra toward your account can, in the long run, reduce the amount you pay in finance charges over the life of your financing. The first way to reduce the finance charge is to make prepayments, i.e. How to reduce finance charges on a car loan.

Since finance charges are the credit card issuer's way of charging you for carrying a balance, the simple way to avoid finance charges is to pay your full balance each. The simplest way to reduce the finance charge is to avoid accruing interest on your balance. If you make all your monthly payments before your scheduled due date, you will pay a smaller amount in interest over the term of your contract than what is disclosed in your contract.

You will often get a grace period of around 21 days after receiving the bill in which to do this. Paying above and beyond what your required monthly payment is. How to avoid finance charges the best way to avoid finance charges is by paying your balances in full and on time each month.

:max_bytes(150000):strip_icc()/170886185-56a1dec83df78cf7726f5da6.jpg)